VAT in a post-Brexit world

VAT

If you have a Zoho Books account, you may have already noticed the new Brexit Updates tab that has appeared there. If you don’t, you may find these details useful anyway. If you want one or would like to know more about Zoho’s Finance solutions, then please get in touch!

As far as the Finance World goes!

For a no-deal Brexit, you’ll find more about VAT, straight from the horse’s mouth, on the Government website and specifics for each of the below headings in their ‘Trading with the EU if there’s no Brexit deal’ notice.

These are the current salient points:

Sales

Unless the EU rules change, goods entering the EU will be treated in the same way as goods entering from other non-EU countries.

If you are VAT registered, you can continue zero-rate sales, but won’t need to complete EC sales lists for goods. This means that these sales will need to be recorded elsewhere with a need to retain evidence that proves the goods have left the UK. Apparently, most businesses will already be doing this and the differences in the process will be communicated in due course!

If you are exporting from the UK, here’s how to get your business ready, including moving goods from Northern Ireland to Ireland.

Purchases

Reading between the lines, if there is no deal, imports from the EU will be treated in the same way that we currently treat imports from non-EU countries. Although there may be some additional changes.

If you are importing from the EU, here’s how to get your business ready, including moving goods from Ireland to Northern Ireland.

VAT Return

As far as the accounts go, the government plan to introduce postponed accounting for import VAT. So UK VAT registered businesses will be able to account for import VAT on their VAT return rather than paying the import VAT as, or shortly after, the goods arrive.

Other Transactions

Our resident accountant, Catharina Davies FMAAT says “We at A2Z Cloud cannot give out tax advice though we can outline the Brexit no deal impact on VAT and treatment within Zoho Books. Still confused? Please contact your accountant or HMRC for further information.”

It seems we’re not short on information, or additional work to do. Now all we need is a decision!

Note: These changes are applicable only in the event of a no-deal Brexit and are correct at the time of publishing. Anything could have happened since then!

Share this article

Read More From The Blog

Zoho Connect – The Standout Alternative to Meta’s Workplace

Meta has recently announced the upcoming closure of its Workplace platform, a decision that will significantly impact the businesses and organisations relying on it for employee engagement and internal communication. With a planned transition period and a strategic...

CXOTalks Interviews ITV at Zoho Day 2024 About Digital Transformation

At Zoho Day 2024, held in the city of McAllen, Texas, Robert O’Brien, Head of International Technology at ITV Studios, sat down with Michael of CXOTalks to discuss the broadcaster’s ambitious digital transformation journey. The conversation highlighted ITV’s...

Zoho’s ‘CRM for Everyone’ – What’s Expected?

In this blog, A2Z Cloud dives into Zoho's latest announcement, CRM for Everyone, exploring the key features, benefits, and potential challenges. We'll provide insights on how this new system can improve your organisation's efficiency, collaboration, and customer...

Zoho People 5.0 Review: Has Zoho Delivered on Their Promise?

With the release of Zoho People 5.0, Zoho promised a much-needed overhaul of its user interface and a host of new features to streamline human resources and workforce management. As the early indicators come in, it's time to evaluate whether Zoho has delivered on its...

Zoho Premium Partner

A2Z Cloud is one of the top Zoho Premium partners in the UK with a room full of talented Zoho Developers, Dedicated trainers, and skillful project managers to ensure that your entire journey with us is a smooth one.

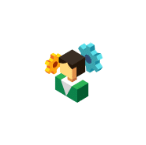

Join the A2Z Angle

Looking to stay ahead of the curve in the fast-paced world of tech? Look no further than A2Z Cloud's monthly newsletter. Join us today for exclusive access to deep dives on all the techie subjects you crave, with must read content from our top partners, plus exciting event announcements and inspiring customer stories.

It's all delivered straight to your inbox, once a month only, so you never miss a beat. Sign up below.