Why Your Data Never Matches Across Business Systems (And How to Fix It)

You open your CRM. Revenue for Q3 shows one number.

You open your finance system. The same quarter shows another.

You open your analytics dashboard. It displays something different again.

Your first thought is that something has broken. The system isn’t working. There’s a technical fault somewhere in the platform.

That feeling, the one sitting underneath your frustration, is unease.

It’s the moment you realise you can’t fully trust what you’re looking at. At first it shows up as irritation. “That cannot be right.” Then it becomes doubt. “Which one do I believe?” Very quickly, it turns into something more personal.

You start worrying about what you’ve already reported. What decisions were made on these numbers. Whether you’ll be challenged on them in the next board meeting.

There’s a quiet loss of confidence. Not just in the system, but in your own ability to stand behind the data in a room full of stakeholders.

TL;DR

- If your CRM, finance and reporting tools show different numbers, it is rarely a technical fault.

- The usual cause is inconsistent definitions, multiple sources of truth, and data being changed in more than one place.

- Workarounds like spreadsheets and extra dashboards hide the problem rather than fixing it.

- The fix is agreeing definitions, assigning ownership, and designing data flow before adding more tools.

The Trust Crisis Nobody Talks About

Here’s what’s actually happening: the systems are doing exactly what they were set up to do. What’s missing is a clear, agreed way the data should flow and who owns it.

Most organisations cite data-driven decision-making as their leading goal, yet less than half have high trust in the data they use. That gap between aspiration and reality is precisely what happens when your business systems tell three different stories.

The erosion of trust isn’t static. It’s accelerating. A growing majority now say they don’t have complete trust in their organisation’s data for decision-making.

More telling: most business stakeholders now identify data issues first, all or most of the time.

Your leadership team is discovering data problems before your data team does. That’s a quiet indicator that systems are failing at the operational level.

When leaders don’t trust the data, they revert to intuition. They often prefer to make decisions based on their own experience over insights generated through data analytics.

When your business systems show conflicting numbers, executives unconsciously undo years of digital transformation investment. They go back to gut feeling because the alternative, trusting contradictory data, feels worse.

What “The System Isn’t Working” Actually Means

In reality, it’s a sign of data inconsistency across systems: different definitions, different sources of truth, or data being changed in more than one place.

At the point of implementation, most organisations are focused on getting each app working on its own. They’re thinking about what this app needs to do for its team, getting live quickly, and meeting immediate reporting or operational needs.

What they’re not thinking about yet is how data should move between apps over time, who owns it, and what happens when something changes later.

The apps get set up correctly in isolation, but the data flow between them is never fully designed.

When Change Exposes the Missing Design

A common example is a change to how revenue is recorded.

At some point, your organisation decides to adjust how deals are marked as “won”, how invoices are raised, or how revenue should be recognised for reporting.

Your CRM gets updated to reflect the new sales process.

Your finance system continues using the old logic.

Your analytics platform still reports on a mix of both.

What breaks down is alignment. The change was made in one place without redesigning how the data should flow across all systems. That’s when the numbers stop matching and trust in the data starts to slip.

The First Move Everyone Makes (And Why It Fails)

The first thing organisations do is export the data into spreadsheets.

Someone pulls reports from your CRM, finance system, and analytics platform and tries to reconcile the numbers manually. They compare totals, adjust filters, tweak date ranges, and try to “make it make sense”.

At that stage, you’re not thinking about data governance or root causes. You’re trying to answer an immediate question like:

“Which number do we trust for this meeting?”

“What do we put in the board report?”

Only later, often much later, does anyone step back and ask why the systems don’t agree in the first place.

The real pattern looks like this:

- Manual reconciliation

- Short-term workarounds

- Loss of confidence in reports

- Acceptance that “the data is messy”

That behaviour is exactly why trust in the data erodes quietly rather than being fixed early. Instead of addressing the root cause of poorly integrated systems, organisations put a band-aid on it and employ extra people to tinker with Excel and data.

What “Messy Data” Actually Looks Like

When an organisation has accepted that “the data is messy”, you can feel it straight away.

People hesitate before answering simple questions. They will say things like, it depends which report you look at, or that is roughly right, but do not quote it.

Structurally, it shows up as small workarounds everywhere:

- Extra fields added because the original ones no longer quite fit

- Reports that only one person trusts

- Analytics dashboards that exist mainly to explain why the numbers don’t line up elsewhere

- Spreadsheets saved on desktops “just to double-check”

“Messy” isn’t chaos. It’s normalisation. It’s a system setup where people have quietly stopped expecting the truth to come straight from the system and have learned how to work around it instead.

This doesn’t happen all at once. It follows a pattern.

The Pattern That Makes Drift Inevitable

What usually happens is not poor planning. It’s reasonable decisions made at different moments, each solving an immediate problem.

It typically goes like this.

Stage One: Sales Visibility

An organisation starts with a CRM to fix sales tracking. It’s set up quickly, often to replace spreadsheets or another tool. At that point, the focus is getting visibility and momentum, not long-term structure.

Stage Two: Financial Control

Later, finance needs better control, so an accounting system is added. It’s connected to CRM just enough to work, but the two teams think about revenue slightly differently. That gap is small at first, so it’s ignored.

Stage Three: Reporting Pressure

As the business grows, reporting becomes harder. Leadership wants answers fast, so a business intelligence tool is introduced to bring everything together. Instead of fixing inconsistencies at source, the reporting layer absorbs them so the numbers “look right”.

Stage Four: Operational Expansion

Over time, more apps are added to solve specific needs. Projects, subscriptions, inventory, people data. Each one is implemented to meet a moment, not redesign the whole picture.

No one ever stops to step back and ask, “Has our data model kept up with how we now operate?” Because day-to-day work takes priority.

Drift becomes inevitable. Not because the systems aren’t capable, but because the technology stack grows in response to pressure, not through deliberate design.

Where the Gap Starts: Sales vs Finance

It usually starts with timing and meaning, not disagreement.

Sales and finance both say “revenue”, but they’re answering different questions.

Sales tends to think in terms of:

- What’s been sold

- When a deal is marked as won

- What’s been committed by the customer

Finance thinks in terms of:

- What’s been invoiced

- What’s been paid

- What can be recognised and reported

At the beginning, that difference feels small and manageable. Everyone knows it’s “roughly the same number”, just viewed from a different angle.

The problem is that systems don’t understand “roughly”. – the CRM and finance numbers do not match. Period.

Your CRM might treat revenue as the value of a won deal.

Your finance system treats revenue as money that’s been invoiced or received.

Your analytics platform then pulls from both and exposes the gap.

As the business grows, those small differences compound. Deals span months. Invoices are split. Credits are issued. Forecasts change. Each system stays internally consistent, but they drift further apart from each other.

What started as a harmless difference in perspective becomes a structural mismatch. And because no one ever stopped to align the definitions properly, the organisation ends up arguing about numbers instead of trusting them.

Why Fixes Make Things Worse

When numbers don’t line up, building another report or adding a script feels productive because it produces something visible. A dashboard updates. A calculation “fixes” a discrepancy. A meeting gets through without awkward questions.

In that moment, it looks like the problem has been solved.

What’s actually happened is that the inconsistency has been hidden, not removed.

Reports sit on top of the data, so they compensate for differences instead of stopping them at source. Scripts correct outcomes after the fact rather than fixing why the data diverged in the first place.

Each fix makes sense on its own, but it adds another layer of logic that only a few people understand.

Over time, the system becomes harder to reason about. Fewer people trust the numbers. More exceptions appear. More fixes are added.

It feels productive because it helps today’s problem. It makes things worse because it pushes the real alignment decisions further down the road, where they become even harder to untangle.

What Proper Architecture Actually Looks Like

When you architect your business systems properly from the start, it looks less like “setting up apps” and more like agreeing how the business is going to run day to day, and making the systems reflect that.

The biggest difference is the decisions you make early on. They’re not technical. They’re basic but important.

Here’s what gets decided differently:

You agree what key words actually mean

Revenue, customer, deal, order, renewal, churn, active, won, cancelled.

Not as theory. As “when you say revenue in a meeting, what are you actually counting?”

You choose a source of truth for each key thing

Sales pipeline lives in your CRM.

Financial actuals live in your finance system.

Stock sits in your inventory system, if it’s needed.

Your analytics platform reports what’s already true, it doesn’t “fix” the truth.

You map what happens next when something changes

A deal slips a quarter.

An invoice is part paid.

A credit note is raised.

A customer churns and returns.

You decide what each system should do in those moments, so the numbers stay aligned.

You design the flow before you configure

What starts in your CRM.

What gets created in your finance system.

What gets updated, when, and by who.

You do this in plain language with the teams, not just in a technical spec.

You stop duplicate work before it starts

You remove the need for people to retype the same data in multiple places.

If someone has to “copy and paste” between apps, you treat that as a sign something is missing.

You build reporting on agreed definitions, not personal spreadsheets

You make sure everyone knows which numbers are for forecasting and which are for actuals.

You make sure the reports answer real questions without needing someone to “adjust them” before meetings.

What you end up with is a system setup where people don’t have to guess which number is right. They can open your CRM, finance system, and analytics platform and understand why figures look the way they do, because the rules were agreed upfront.

That’s the difference. It’s not magic. It’s getting the decisions that people usually avoid making, made early, with the right people in the room.

Why Organisations Avoid the Alignment Conversation

Those conversations are uncomfortable in a way spreadsheets are not.

Most organisations avoid them because they force decisions that cut across teams, power, and habit.

In real life, it’s easier to live with messy data than to ask:

- Who actually gets the final say on definitions?

- Whose number is “right” when they don’t match?

- Who owns fixing this when it spans sales, finance, and ops?

- What existing processes need to change, not just the system?

Those questions surface tensions people would rather park.

Alignment conversations, on the other hand, require:

- Slowing down when everyone is busy

- Agreeing things out loud that were previously assumed

- Accepting that someone’s way of working will need to change

Living with messy data feels easier in the short term. The irony is that avoiding it is exactly what makes the mess grow over time.

The Hardest Part of Fixing It Properly

The hardest part is getting everyone to slow down and agree the truth together a “single source of truth” if you’ll pardon the cliché.

It’s the moment when the organisation realises this isn’t a “data problem”, it’s a people and ownership problem. Until that’s resolved, teams tend to hover at the edge, asking for technical changes without committing to the behavioural ones.

The organisations that succeed are the ones that accept a short period of awkward clarity in exchange for long-term confidence and system integration. They choose alignment over comfort.

That’s the real work.

What This Actually Reveals

When your numbers don’t match across systems, you’re not looking at a platform failure.

You’re looking at a diagnostic window into how your organisation actually operates.

The mismatches expose:

- Decisions that were made in isolation

- Conversations that were avoided

- Ownership that was never clearly assigned

- Changes that were layered on without redesigning the foundation

Modern business platforms are designed to be connected, but they rely on correct system relationships and clear data ownership. When those foundations are missing, the platform does exactly what it was configured to do. The problem is that the configuration reflects fragmented thinking, not fragmented software.

In platforms like Zoho, which are designed to work as connected ecosystems, these gaps become visible faster. Not because the platform is failing, but because it’s exposing misalignment that was always there.

The organisations that fix this properly recognise the pattern early. They stop treating symptoms. They have the uncomfortable conversations. They agree definitions out loud. They assign ownership clearly.

They architect their business systems to reflect how the business actually runs, not how it ran when the first system was implemented.

That’s when the numbers start to match. Not because the platform changed, but because the thinking did.

One path leads to confidence in your data. The other leads to spreadsheets on desktops and hesitation before every board meeting.

You get to choose which one.

Frequently Asked Questions

Why do CRM and finance numbers not match?

In most cases, it is not a technical fault. CRM and finance systems often use different definitions and timing rules.

CRM typically reflects what has been sold or marked as won, while finance reflects what has been invoiced, paid, or recognised.

If definitions are not agreed and the data flow between systems is not designed, small differences compound over time.

What does “single source of truth” actually mean?

A single source of truth means each key business metric has one authoritative place it is created and maintained.

For example, your CRM can own pipeline and forecasting, while your finance system owns actual revenue and payments.

Other tools can report on that data, but they should not “correct” it with hidden logic or manual workarounds.

What are the most common causes of data inconsistency across systems?

The most common causes are inconsistent definitions, data being edited in more than one system, and integrations that are partial,

one-way, or built around exceptions rather than agreed rules. Over time, quick fixes such as scripts and reporting patches hide the

misalignment instead of removing it.

How do you fix data that does not match across business systems?

Start by agreeing what key terms mean in plain language, then assign ownership for each metric and system.

Map what should happen when data changes (for example, partial payments, credit notes, renewals, or deal slips),

then design the flow before configuring tools. The goal is to prevent duplicate data entry and ensure reporting reflects

agreed definitions rather than personal spreadsheets.

Is adding a BI dashboard a good way to solve mismatched numbers?

A BI tool can help visualise what is happening, but it does not fix the root cause on its own.

If the reporting layer is forced to “make the numbers look right”, it can mask inconsistencies and create more logic that only a few

people understand. BI works best when it reports on data that is already aligned at source.

How can connected platforms reduce data drift over time?

Connected platforms reduce drift by making it easier to standardise data structures, ownership, and workflows across teams.

When systems share consistent rules and relationships, changes are less likely to be made in one place without being reflected elsewhere.

The key is still governance and design, but a connected ecosystem lowers the integration burden and reduces the number of moving parts.

Ready to harness AI in your business?

Book a free consultation with our team today! Let’s chat about your goals, challenges, and how we can help you unlock your business’s full potential.

Share this article

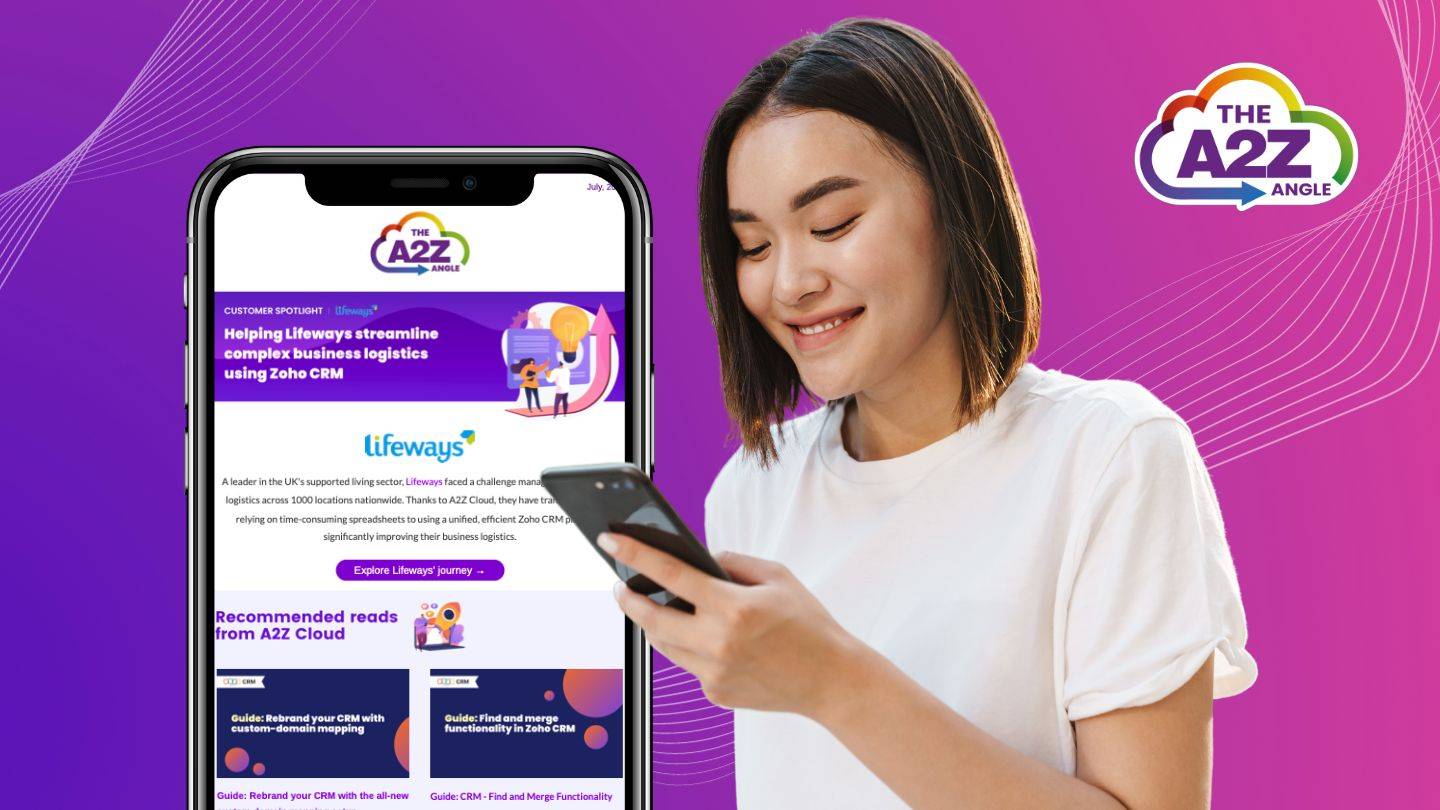

Join the A2Z Angle

Looking to stay ahead of the curve in the fast-paced world of tech? Look no further than A2Z Cloud's monthly newsletter. Join us today for exclusive access to deep dives on all the techie subjects you crave, with must read content from our top partners, plus exciting event announcements and inspiring customer stories.

It's all delivered straight to your inbox, once a month only, so you never miss a beat. Sign up below.